These transitions impact many people, especially the owners and the management teams.

Valuation is a very critical factor during these transitions because it has to be a number that fairly represents the value of the business for the outgoing owners while providing a solid return for the buyers.

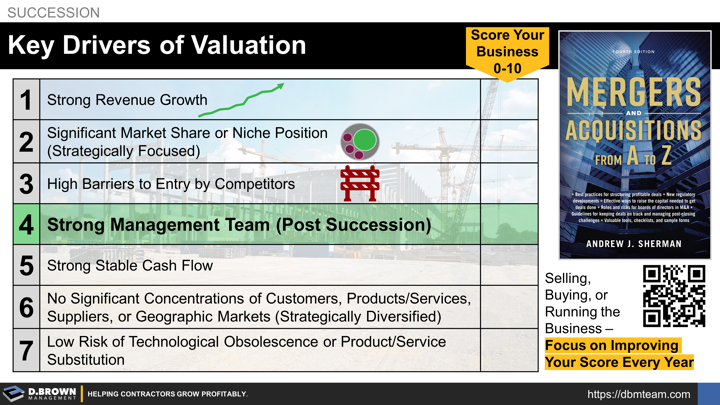

Andrew J. Sherman just published the Fourth Edition of Mergers & Acquisitions which should be read by anyone who is or could potentially be on either side of a transaction. He laid out 7 Valuation Drivers:

- Strong Revenue Growth

- Significant Market Share or Niche Position

- Barriers to Entry by Competitors

- Strong Management Team

- Strong Stable Cash Flow

- No Significant Concentrations in Customers, Products, Suppliers or Geographic Markets

- Low Risk of Technological Obsolescence or Product Substitution

For a contractor, numbers 3 and 7 don’t typically apply.

Number 4 - Building a strong management team is the leverage point that makes the other factors sustainable in the long-run and, therefore, truly valuable.

Focus on building your most valuable asset; a strong management team.