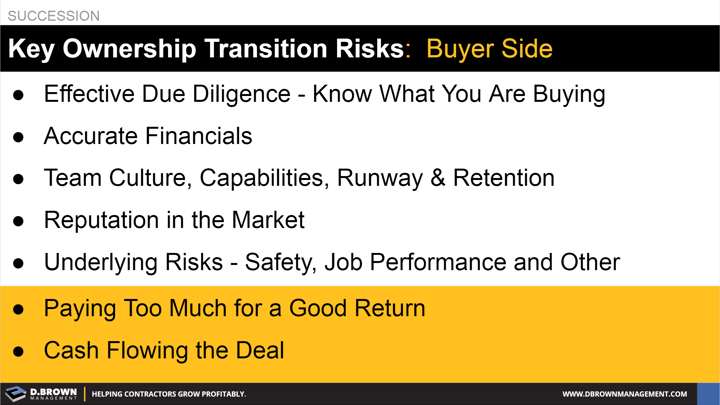

While different, buyers of a construction business have just as many risks as sellers. Each will tend to discount the risks of the other, impacting the ability to create the best deal.

- The seller has deep knowledge about all operating dynamics of the business. The buyer must rely on very effective due diligence to truly understand what they are buying. A purchase by management will have the advantage of time with the company. An outside buyer will have the advantage of a structured process, but neither will have the clarity that the current seller has.

- True accuracy of the financials are hard to assess depending on the sophistication of the contractor. Often there are related party balance sheet transactions and non-business expenses buried deeply within the financials that are hard for anyone, including external CPA auditors to identify.

- The team is truly what the buyer is purchasing. Getting to know the culture, team, and their capabilities is crucial but difficult for an outside buyer.

- Underlying risks that may come up years in the future are difficult to quantify, which is why many outside buyers do an asset purchase.

- The buyer has to be cautious when it comes to paying too much because they may not be able to cash flow the transaction or generate the returns they were projecting.

Deeply understanding the risks for both parties is a great start to creating the foundation of a deal.