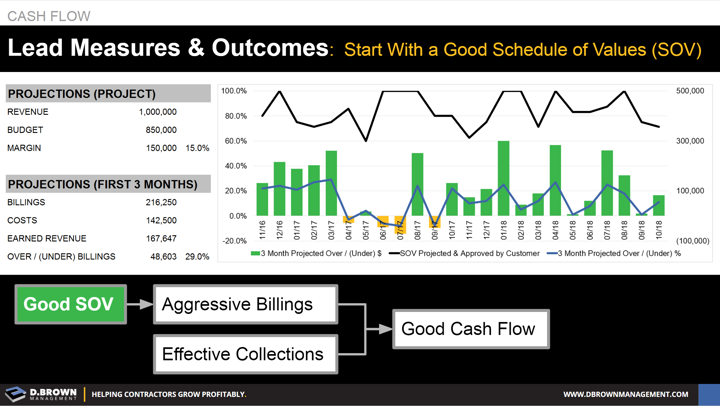

It is nearly impossible for a contractor to have consistently great cash flow if they have a Schedule-of-Values (SOV) that isn’t loaded properly and integrated with the project schedule, including a projection of the project cash flow.

With that in mind, consider the Leading Activities and Measurements that will let you know how this is going:

TARGET: We want to have an effectively loaded SOV that is approved by the customer and has a cash flow projection for all projects over $_______ in revenue before the project starts.

MONTHLY MEASUREMENTS:

- How many jobs had their first field labor costs that were over $_______ in revenue indicating project starts?

- Of those, how many had both (1) a customer approved SOV and (2) a cash flow projection based on that SOV, budget, and project schedule that were reviewed with the PMs manager or finance?

- Like measuring Percent Planned Complete (PPC) on a project, the target is 100% and misses should be analyzed so the team can learn.

- Of those cash flow projections completed and looking at the first 3 months of the project, what was both the percent over / (under) billed compared to the projected earned revenue during that period? How much is that expressed in dollars?

The trend on these metrics are the Lead Measures predicting success at the Over / (Under) billing metric and, ultimately, the Project Cash Metric.