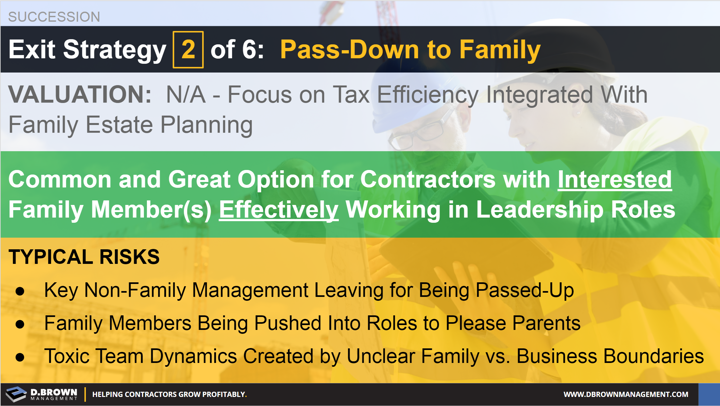

The valuation focus for these deals is on tax efficiency and risk management by tightly integrating the transaction with estate planning. The upside is that there are typically solid tax savings with this type of deal.

The typical downsides of these deal structures include:

- Deal structures that potentially make adding non-family members as equity partners difficult.

- The deal structure keeping the incoming owners from feeling the full weight of their capital-at-risk that would typically be felt by a non-family buyer. This is a very underestimated dynamic that often negatively impacts professional development and business performance significantly.

Other common risks include:

- Key non-family management team members leaving if they feel they are being passed up, which is why there is a huge burden for family members to be effectively performing in leadership roles prior to succession.

- Family members being pushed into roles they don’t want to please their parents, which negatively impacts them personally, the business performance, and family dynamics.

- Toxic team dynamics created by unclear boundaries between family and business.