Profit margins are so tight and cash flow is so challenging at the project level that this must occur?

- On a scale of 0-10 how would you rate your team’s ability to deliver projects consistently within your budget?

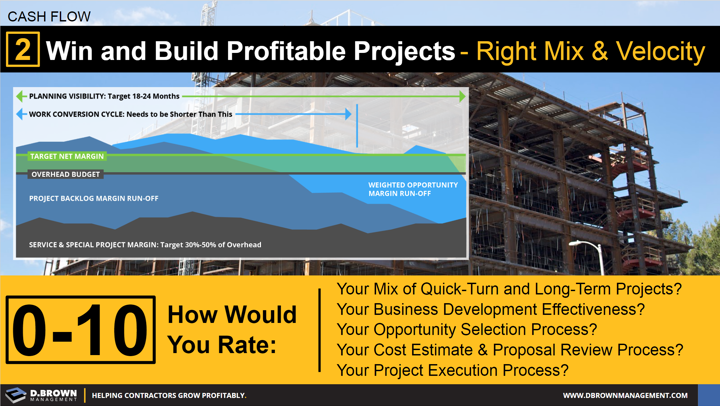

Even more challenging is how cash flow looks at the company level when you factor in overhead.

What makes the biggest difference for company level cash flow is how you stack multiple projects together into your backlog.

- Do you have some projects that turnaround quickly utilizing less working capital?

- Do you have some projects that have 18-24 month plus schedules from the time you hear about the opportunity until construction is complete to add to stability?

- Are you happy with that mix of projects and how they make your cash flow at the company level?

- On a scale of 0-10 how would you rate the effectiveness of your opportunity selection process at limiting your risk while aligning your resources?

Tips 1 & 2 are just the foundation upon which great cash flow tactics really start to work.

We are revamping our publicly available cash flow workshop that includes these 18 tactics that contractors can use to accelerate cash flow. Stay informed of updates on release.