They are putting their capital at risk, making a calculated bet on the business generating consistent financial returns at the lowest risk possible.

Whether you are an equity owner in a contracting business, plan to be or are choosing to invest your professional “career equity” into the business, you should look at the same factors an outside financial partner does. This will truly align everyone’s interests and make the business run more successfully.

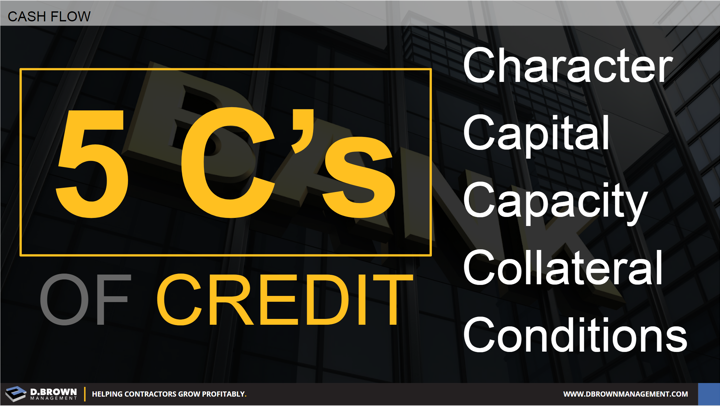

Greg Martin does a great job of describing the 5 C’s of Credit in a series of articles below.

Effectively managing cash flow is about balancing what you can do internally while building and maintaining strong external financial partner relationships.

- What are your internal capital management policies?

- Are they in alignment with your outside financial partners?

- How does this look over the next 5 years or during succession if that is on the horizon for you?