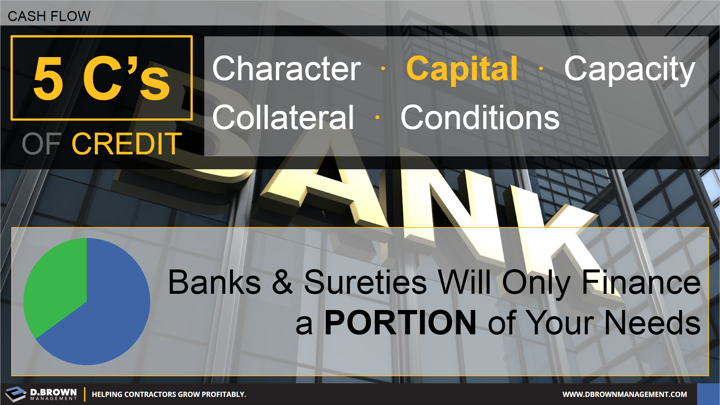

The 2nd of the 5Cs of Credit is how much capital you are putting at risk, along with your financial partner.

Regardless of whether you are looking at:

- Operating Line-of-Credit (LOC)

- Financing for Equipment or Vehicle Purchases

- Real Estate or Construction Financing

- Surety (Bonding)

- Insurance With Some Form of Shared Risk

Your financial partner will want you to put some of your own capital into the deal and that will come in the form of:

- Letter-of-Credit from your bank tying up a portion of your LOC.

- Actual cash put in as a down payment for real estate or equipment financing.

- Minimum levels of equity or, more specifically, Tangible Net Worth (TNW) from the perspective of your financial partner. This TNW calculation will typically exclude things like intangible assets (goodwill, etc.), related party transactions, and doubtful accounts.

- Minimum ratios such as Total Liabilities / TNW

These are negotiable with the other 5Cs taken into consideration. Our recommendation is that contractors design and follow their own very strict capital management policies appropriate for their business.