This is especially true with the tightening labor market that will continue to worsen through 2030.

Alignment comes from being transparent with your guiding principles or values and living them every day with integrity, as described by Dr. Brené Brown.

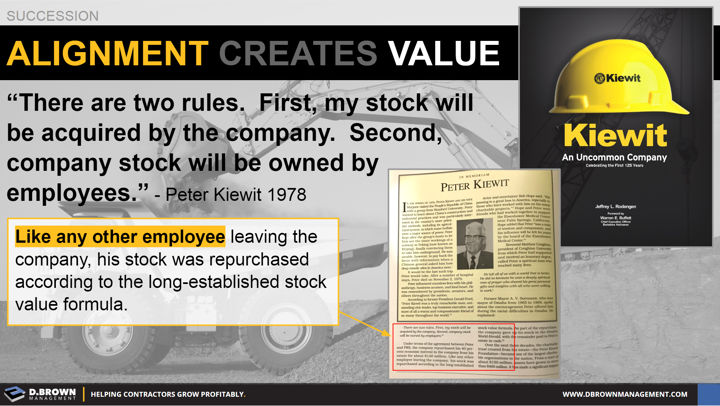

Kiewit is a great example of how this alignment built a business that has been sustainably growing for over a century.

In their book, there is a section about Peter Kiewit and how he sold his shares to the company using the same formula that applied to every other employee owner. Additionally, he set a couple of simple rules in place around how ownership was to be handled.

While their employee ownership plan and strategy is more complex in execution, there are these simple guiding rules and their value of “Stewardship” that form the foundation of this alignment.

If you are interested in learning more about how some of these tactics could apply to your business, reach out to Sue Weiler-Doke for a conversation.

Lonnie Morelock can talk about how this aligned the field effectively.